Subtotal: $47

Learn Options on Futures for Hedging Options and Stocks

$38

Shopping Instructions:

- DISCOUNT 15% : SHOP15

- Product Delivery: Within 1 – 12 hours after purchase.

Futures can play an important role in an Options investment context, because they can be great hedging instruments to an existing portfolio. File Size: 262.1 MB

Learn Options on Futures for Hedging Options and Stocks

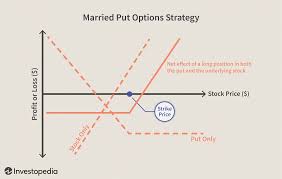

Futures can play an important role in an Options investment context, because they can be great hedging instruments to an existing portfolio. This course introduces a new type of instrument – Options on Futures. An Option on a Future means that the underlying asset is the Future itself. This is bound to sound complicated, but its explained in detail. In general, unless you’re a Futures trader, you would not trade these instruments. However, what both these products offer is a 24-hour trading window. Therefore, if you had a normal portfolio comprised of Stocks and Options, and were concerned of some crisis brewing in overnight markets, its possible to hedge your portfolio in the middle of the night. This course shows how to do this using both these instruments.

Who this course is for:

Get immediately download Learn Options on Futures for Hedging Options and Stocks

Any Options trader wanting to expand understanding of Options on Futures

Option Traders interested in advanced Hedging techniques using Options on Futures

Traders wanting to hedge Overnight news or Geopolitical Risks

Here’s What You’ll Get in Learn Options on Futures for Hedging Options and Stocks

Learn Options on Futures for Hedging Options and Stocks : Sample

Related products

Business & Sales

Internet Marketing

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Alwyn & Rachel Cosgrove – Results Fitness University

Alwyn & Rachel Cosgrove – Results Fitness University