Real Estate Investment Analysis

$765 Original price was: $765.$102Current price is: $102.

Shopping Instructions:

- DISCOUNT 15% : SHOP15

- Product Delivery: Within 1 – 12 hours after purchase.

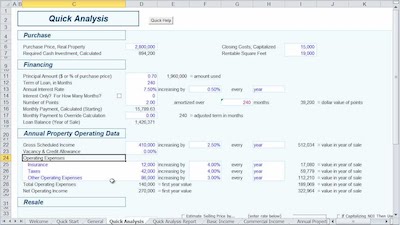

This course examines residential, commercial, industrial, and special-purpose real estate investments using various data sets and analysis techniques that are fundamental to analyzing real estate investments.

Real Estate Investment Analysis

This course examines residential, commercial, industrial, and special-purpose real estate investments using various data sets and analysis techniques that are fundamental to analyzing real estate investments.

What you can learn.

- Review application of investment ratios to expense factors, mortgage loan constants, and equity yields before and after income and capital gains taxes

- Explore key topics that include capitalization, negative vs. positive leverage, depreciation methods, and recapture

- Gain an understanding of how senior, junior, and inclusive trust deeds, fee, leasehold, and subordination alternatives are employed separately and in combinations

About this course:

A must for anyone dealing with the investment aspects of real estate. This course examines residential, multiresidential, commercial, industrial, and special-purpose real estate investments, as well as reviews application of investment ratios to expense factors, mortgage loan constants, and equity yields before and after income and capital gains taxes. Other topics include capitalization; negative vs. positive leverage; depreciation methods and recapture; simplification of actuarial tables and mathematical formulas; internal rates of return; net present value; related yield measurement techniques; senior, junior, and inclusive trust deeds; fee, leasehold, and subordination alternatives and combinations; explanation and calculation of financial provisions of commercial leases; and prevailing rental rates and operating expenses. Working knowledge of a Financial Calculator (HP12C, HP10B II, etc.) and Microsoft Excel, or other popular spreadsheet software, is highly recommended.

Suggested Prerequisites

It is advisable that you complete the following (or equivalent) since they are prerequisites for Real Estate Investment Analysis.

Read more: http://archive.is/V5th3

Course Features

-

Lectures

0 -

Quizzes

0 -

Duration

Lifetime access -

Skill level

All levels -

Students

0 -

Assessments

Yes

Related products

Sale!

Real Estate

Rated 5.00 out of 5

Sale!

Real Estate

Rated 5.00 out of 5

Sale!

Real Estate

Rated 5.00 out of 5

Sale!

Real Estate

Albert Lowry – Complete Real Estate Auctions and Foreclosures Course LOWRY Real Estate Course

Rated 5.00 out of 5

Sale!

Real Estate

Rated 5.00 out of 5

Sale!

Real Estate

Rated 5.00 out of 5

Sale!

Real Estate

Rated 5.00 out of 5